Annual Financial Statement1

All Yearly Financial Statements

Attachments:

All Yearly Financial Statements

Attachments:

The Organisation Structure shows the internal operations of the RBV. The internal operations are organized into four main departments namely, Research, Financial Institution Supervision, Operations, and Administration. The Information & Communications Technology (ICT) Unit was created in 2002 from the functions of data processing office of the Operations department and reports directly to the Deputy Governor. The Legal Counsel Reports Directly to the Governor. Departmental key roles are as follows:

Governor's Office

The Core roles of the office of the Governor and the Executive Management are comprised of the following:

Research & Statistics Department

The Research department's main responsibility is to conduct economic analysis and provide advice on the formulation of monetary policy. Some of the department's key tasks include:

Financial Institution Supervision Department

One of the roles of the Reserve Bank of Vanuatu (RBV), as defined under Reserve Bank of Vanuatu Act [CAP 125] is to supervise domestic and offshore (or international) banks. This function is carried out by the Financial Institution Supervision Department, which is responsible for the supervision of domestic banks licensed under the Financial Institutions Act of 1999 and offshore banks licensed under the International Banking Act of 2002 and Insurance companies licensing under Insurance Act of 2005.

Some of the key areas that are outlined in the Acts include;

Accounts & Customer Services Department

The Operations department has the primary responsibility for aspects of corporate, banking and financial services, reporting and currency issue. It comprises the Offices Accounts & Customer Services, Currency and Foreign Exchange.

Accounts Office

The office is responsible for the processing and reporting of the Bank's accounts. Its key tasks include:

Customer Services

The Office operates banking services with account holders and counter transactions with the public. It also supervises the Port Vila Clearing House for settlement of the inter-bank domestic payment system.

The Currency Office

The office's primary responsibility is to ensure the availability and supply of good quality currency. Key task areas include:

Financial Markets Department

The primary responsibilities of the Office are:

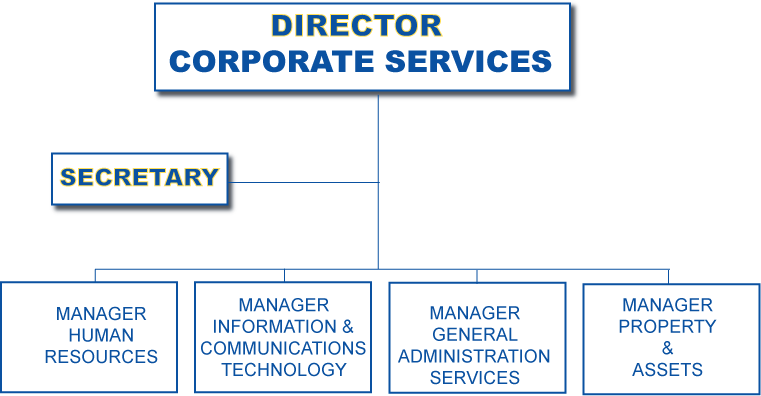

Corporate Services Department

The Corporate Services Department (CSD) is primarily responsible for providing internal support services including: information technology; human resources management; plant & properties management; security; and general administration. The Department’s current structure was approved by the board after the major restructure of the Bank in 2008.

To carry out its function, the Corporate Services Department is notionally split into four (4) operational Units:

1. Human Resource Unit (HRU)

2. Information & Communication Technology Unit

3. General Administration Services Unit

4. Property & Assets Unit

Information Technology (ICT) Unit

The primary function of IT is to maintain the Banks computer systems and network including the Bank's management information system within its Intranet The Unit is responsible for advise to management on appropriate hardware configuration and software application and systems. The IT Unit reports directly to the Deputy Governor.

Legal Counsel

The office of the Legal Counsel is directly under the Governor’s Office. Its prime responsibility is to provide legal advise to the Bank in general in relation to issues arising under the governing legislations and other relevant legislations affecting the operation of the Bank. It also ensures that the Policies of the Bank are complied with. Other task involves drafting and conveyancing. All legal queries of the Bank from the different departments are also directed to the Legal Counsel.

1. How can I tell the difference between a genuine and counterfeit banknote?

Vatu banknotes have security features which are easily identifiable such as:

2.Can I reproduce or make copies of banknotes?

The RBV Act [CAP125] prohibits any person other than the Reserve Bank to issue currency in Vanuatu.

It is therefore a crime to reproduce Vatu banknotes (fake or copies) and anyone caught doing that will be prosecuted.

3.What should I do if I have damaged (burnt or torn) banknotes?

Damages do not take away the face value of genuine banknotes. Any damaged banknotes must be taken to the Reserve Bank who will determine if the damaged notes can be exchanged with reissue notes.

Commercial banks maybe also contacted for assistance with damaged notes.

4.What about soiled coins?

Vatu coins which are soiled and dirty can be still exchanged with a reissue coin at the Reserve Bank.

5.Where do I store my banknotes and coins?

It is advisable to put your banknotes and coins in a bank account where it is safe and in a clean environment.

For any other questions, please contact the Reserve Bank of Vanuatu: